No Tax Due - Tutorial

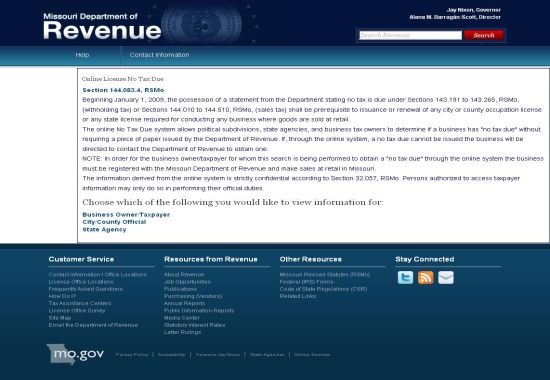

Click the link below for information about the Online No Tax Due System

- Accessing the Online No Tax Due System

- Cities/Counties

- Business Owner/Taxpayer

- State Agency

- Error Messages

- Contact Information

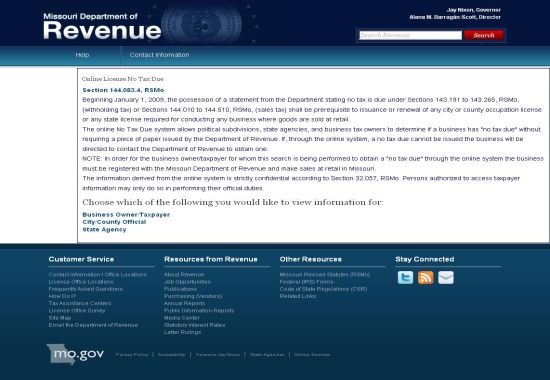

Accessing the Online No Tax Due System

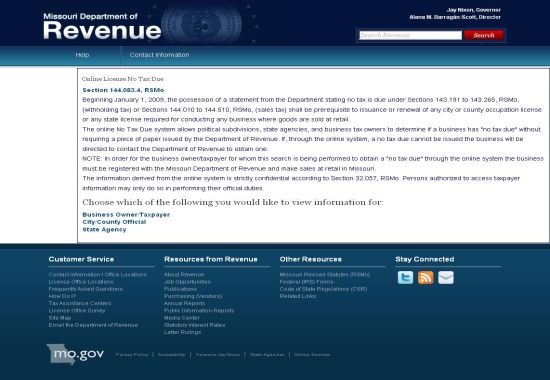

Click here to access the OnLine No Tax Due System.

The possession of a statement from the Department of Revenue stating no tax is due under sections 143.191 to 143.265, RSM0, (withholding tax) or sections 144.010 to 144.510, RSMo, (sales tax) is a prerequisite to issuance or renewal of any city or county occupation license or any state license required for conducting any business where goods are sold at retail.

The online No Tax Due system allows political subdivisions and state agencies to determine if a business has "no tax due" without requiring a piece of paper to be issued by the Department of Revenue. If there is an issue with the business' account and a no tax due cannot be issued, the system will present a message that the business must contact the Department of Revenue to obtain one. This system allows business owners that have complied with Missouri tax laws to print a Certificate of No Tax Due.

NOTE: In order for the business owner to obtain a "no tax due" through the online system, the business must:

- Have a valid registration with the Missouri Department of Revenue;

- Make sales at retail in Missouri; and

- Have no sales or withholding tax delinquencies.

The information derived from the online system is strictly confidential according to section 32.057, RSMo. Persons authorized to access taxpayer information may only do so in performing their official duties.

NOTE: Businesses that do not make sales at retail are not required to obtain a Certificate of No Tax Due.

Cities/Counties

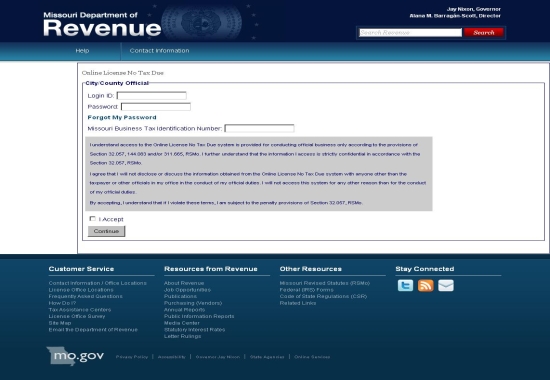

Access Page

Step 1: Click “City/County Official”. This will take you to the portion of the system designed specifically for political subdivision use.

You will need the following to continue:

- Login ID and password. If you don't have a Login ID or password, complete Form 4379A and mail it to the Department. The Department renews Login ID's and passwords on an annual basis.

- Missouri Tax Identification Number of the business for which you are inquiring. This is the 8 digit number issued to the business owner/taxpayer by the Missouri Department of Revenue and is included on the business’ sales tax license.

Step 2: Enter the Login ID & Password that the Department of Revenue assigned to you. The ID is specifically associated with your city or county and will ensure that the taxpayers you are evaluating in the system are evaluated for compliance in your city or county.

If you have not entered the correct User ID or Password you will receive the following message:

- Invalid login. Please re-enter your login and password.

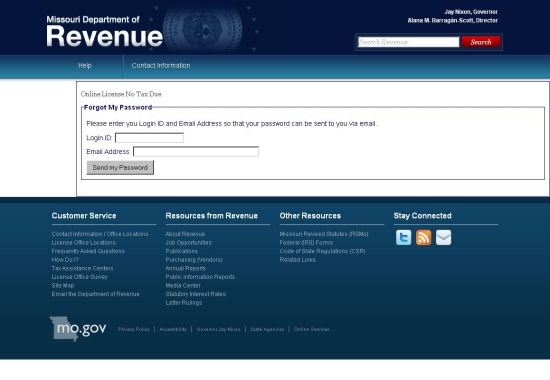

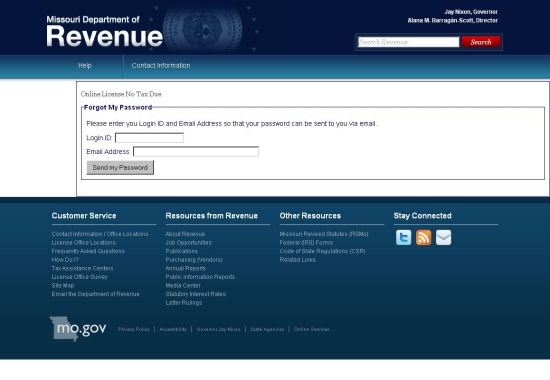

If you have forgotten your password, click on the "Forgot My Password" button. Online No Tax Due System will take you to an email page. Click "Send" and you will receive an email with your user ID and password.

Step 3: Enter the business owner's Missouri Tax Identification Number. It is advisable that on any application for local license, you request that the business provide their Missouri Tax Identification Number. For retail sales businesses, you may want to consider having the business provide a copy of their Missouri Sales Tax License, verifying that the business is licensed for your political jurisdiction. Online No Tax Due will assess the taxpayer’s account and determine if a no tax due can be issued.

If you have entered an invalid Missouri Tax Identification Number, you will receive the following message:

- The Missouri Tax Identification Number you entered is an invalid number. Please re-enter the number.

Step 4: The information you will be accessing is strictly confidential and can only be accessed and used for official purposes. In order to access the information provided by the system, you must agree that you will abide by statutory confidentiality provisions. Select the “I Accept” button to access the system. If you do not select “I Accept”, you will be prevented from entering the OnLine No Tax Due System.

Step 5: Click "Continue".

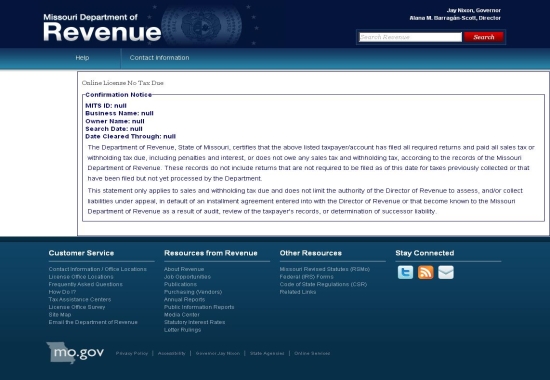

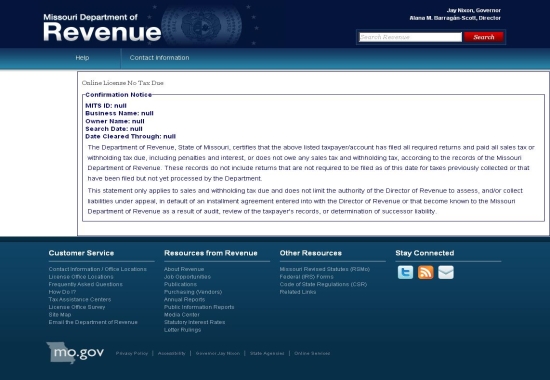

Confirmation Page

If the business has no tax due, Online No Tax Due will present a confirmation page documenting that there is no tax due for this business. To receive a no tax due confirmation page, the business must have a licensed retail sales location in your political subdivision and must be current on sales and withholding taxes. You can print the page for your records or return back to the Search Page to access information on another business in your political subdivision.

Error Messages

If a no tax due confirmation page cannot be presented, Online No Tax Due will present a message documenting that a no tax due confirmation could not be issued. The message will always direct the business to contact the Department of Revenue so that a customer service representative can assist the taxpayer and provide a statement of no tax due. Click here for an explanation of each of the possible messages.

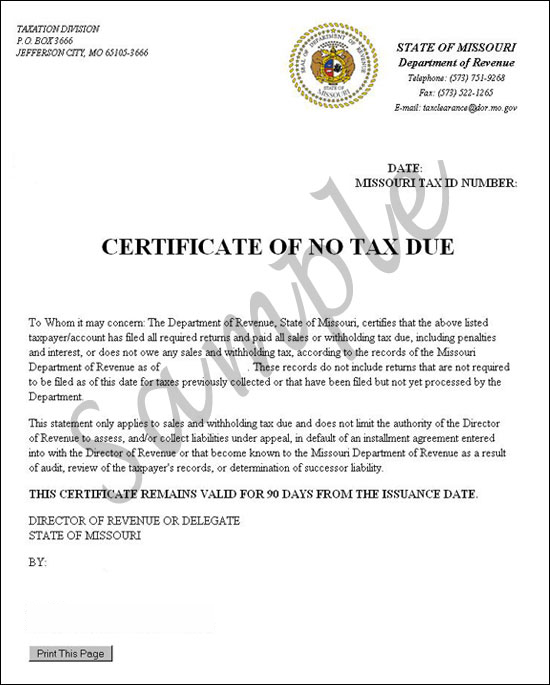

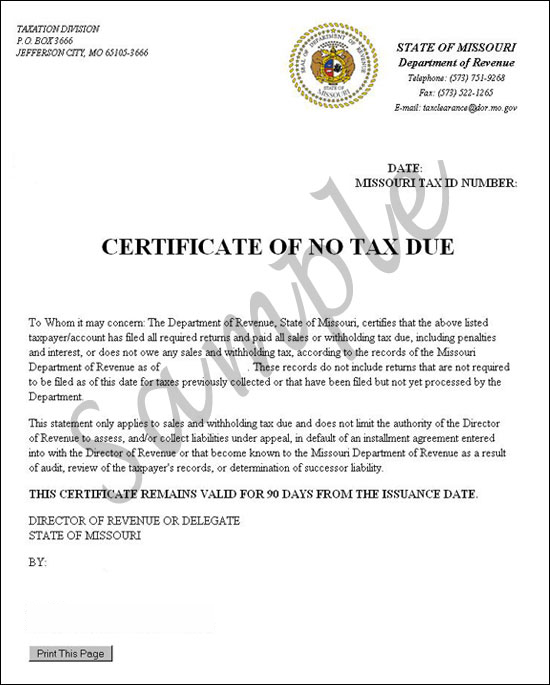

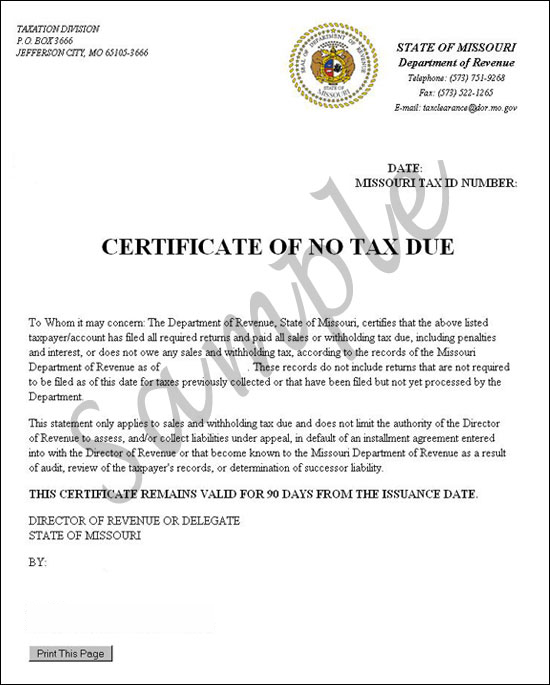

Taxpayers can also access the Online No Tax Due system and can generate a no tax due certificate to present to the political subdivision. Here is an example of what that Certificate of No Tax Due will look like.

Business Owner/Taxpayer

If there are no current registration or delinquency issues, this site will allow you to print your own Certificate of No Tax Due, which you can present to the local or state agency.

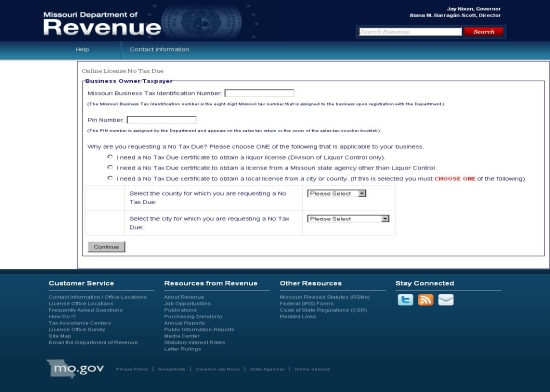

You will need your business’ Missouri Tax Identification Number and tax filing PIN Number.

- Your identification number is the 8 digit number issued to you by the Missouri Department of Revenue to file your business taxes and is included on your sales tax license.

- Your PIN is a 4 digit number located on the cover of your voucher booklet or return.

Access Page

Step 1: Click “Taxpayer”. This will take you to the portion of the system designed specifically for taxpayer use.

Step 2: Enter your Missouri Tax Identification Number and PIN. The Department of Revenue has assigned the PIN number and can be found on the cover of your return or voucher book.

If you have not entered the correct Missouri Tax Identification Number or PIN you will receive the following message:

- Invalid login. Please re-enter your login and password.

If you have entered an invalid Missouri Tax Identification Number, you will receive the following message:

- The Missouri Tax Identification Number you entered is an invalid number. Please re-enter the number.

If you do not know your Missouri Tax Identification Number or PIN, contact the Department of Revenue at 573-751-5860.

Step 3: Why are you requesting a Certificate of No Tax Due? Check the box that applies to you. If you need a Certificate of No Tax Due to obtain a city or county license, select the county or city for which you are requesting a No Tax Due Certificate.

Step 4: Click the continue button and Online No Tax Due will assess your account and determine if a no tax due can be issued.

If you have “no tax due”, the Online No Tax Due will present a No Tax Due Certificate. Print the page so that you may present the No Tax Due Certificate to the city, county or state agency using the “Print this Page” button in the lower left hand corner of the page. Maintain a copy of the Certificate of No Tax Due for your records.

Error messages

If a Certificate of No Tax Due cannot be issued, Online No Tax Due will present a message documenting that a no tax due could not be issued. The message will always direct you to contact the Department of Revenue so that a customer service representative can help resolve any issues before a Certificate of No Tax Due can be issued. Click here for an explanation of each of the possible messages.

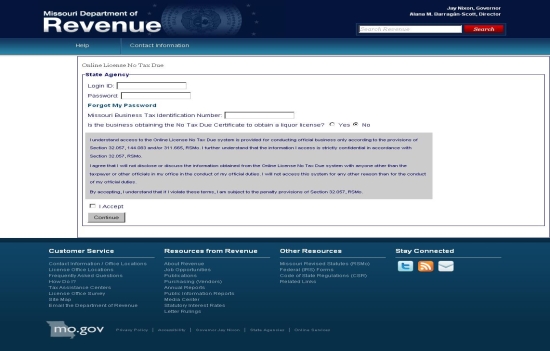

State Agency

Access Page

Step 1: Click “State Agency”. This will take you to the portion of the system designed specifically for state agency use.

You will need the following to continue:

- Login ID and password. If you don't have a Login ID or password, complete Form 4379B and mail it to the Department. The Department renews Login ID's and passwords on an annual basis.

- Missouri Tax Identification Number of the business for which you are inquiring. This is the 8 digit number issued to the business owner by the Missouri Department of Revenue and is included on the business’ sales tax license.

Step 2: Enter the Login ID & Password that the Department of Revenue assigned to you.

If you have forgotten your password, click on the "Forgot My Password" button. Online License No Tax Due System will take you to an email page. Click "Send" and you will receive an email with your user ID and password.

Step 3: Enter the business owner's Missouri Tax Identification Number. It is advisable that on any application for license, you request that the business provide their Missouri Sales Tax Identification Number. Online No Tax Due will assess the taxpayer’s account and determine if a no tax due can be issued.

Step 4: If the taxpayer is selling liquor and you are requesting no tax due information in order to issue a liquor license indicate "Yes".

If you have entered an invalid Missouri Tax Identification Number, you will receive the following message:

- The Missouri Tax Identification Number you entered is an invalid number. Please re-enter the number.

Step 5: The information you will be accessing is strictly confidential and can only be accessed and used for official purposes. In order to access the information provided by the system, you must agree that you will abide by statutory confidentiality provisions. Select the “I Accept” button to access the system. If you do not select “I Accept ”, you will be prevented from entering the OnLine No Tax Due System.

Step 6: Click "Continue".

Confirmation Page

If the business has no tax due, Online No Tax Due will present a confirmation page documenting that there is no tax due for this business. To receive a No Tax Due confirmation page, the business will have a valid sales tax license and will be current on sales and withholding taxes. You can print the page for your records or return back to the Search Page to access information on another business.

Error Messages

If a no tax due confirmation page cannot be presented, Online No Tax Due will present a message documenting that a no tax due could not be issued. The message will always direct the taxpayer to contact the Department of Revenue so that a customer service representative can assist the taxpayer and provide a Certificate of No Tax Due. Click here for an explanation of each of the possible messages.

Taxpayers can also access the Online No Tax Due system and can generate a Certificate of No Tax Due to present to the political subdivision. Here is an example of what that no tax due will look like.

Error Messages

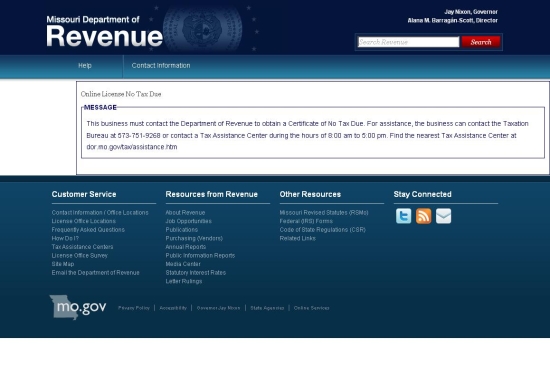

Taxpayer Must Contact the Department of Revenue

The following message will be presented if a Certificate of No Tax Due cannot be issued and the taxpayer must speak to the Department of Revenue in order to resolve any issues before a Certificate of No Tax Due can be presented.

- This business must contact the Department of Revenue to obtain a Certificate of No Tax Due. For assistance, the business can contact the Taxation Division at 573-751-9268.

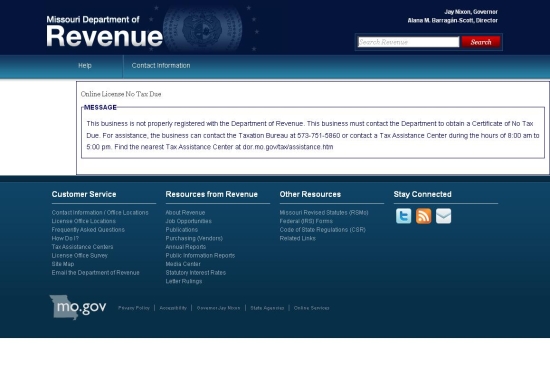

Improperly Registered

The following message will appear if a business is not properly registered with the Missouri Department of Revenue. If an application has already been submitted to the Department there may be missing information that the taxpayer must provide the Department before the registration process can be completed and a sales tax license is issued.

- This business is not properly registered with the Department of Revenue. This business must contact the Department to obtain a Certificate of No Tax Due . For assistance, the business can contact the Taxation Division at 573-751-5860.

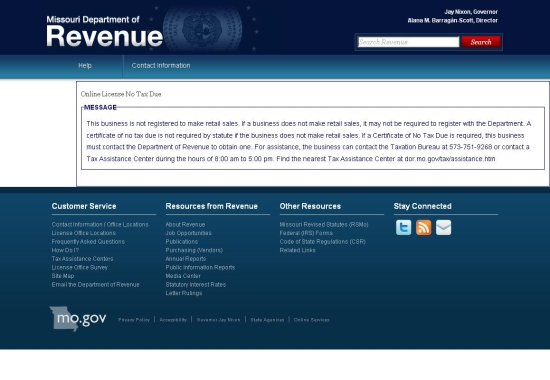

Not Registered for Sales Tax

The following message will appear if a business is not registered to make retail sales in Missouri. A Certificate of No Tax Due is only required if the taxpayer is a retail business and a political subdivision or state agency should not require a no tax due in order to issue the license.

- This business is not registered to make retail sales. If a business does not make retail sales, it may not be required to register with the Department. A no tax due certificate is not required by statute if the business does not make retail sales. If a Certificate of No Tax Due is required, this business must contact the Department of Revenue to obtain one. For assistance, the business can contact the Taxation Division at 573-751-9268.

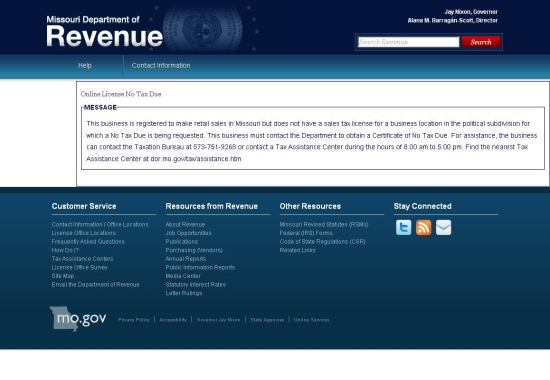

Improperly Registered at the Location Level – City/County License Only

The following message will appear if the business is not licensed in a city or county for which a Certificate of No Tax Due must be presented. The taxpayer should contact the Department and obtain a sales tax license for that city or county. Once the license is issued, the taxpayer can also request a Certificate of No Tax Due . Please note, if the taxpayer also has delinquencies, those delinquencies must be paid before Retail Sales Tax License or a Certificate of No Tax Due can be issued.

- This business is registered to make retail sales in Missouri but does have a Retail Sales Tax License for a business location in the political subdivision for which a Certificate of No Tax Due is being requested. This business must contact the Department to obtain a Certificate of No Tax Due . For assistance, the business can contact the Taxation Division at 573-751-9268.

Contact Information

If you have further questions, please contact us:

Missouri Department of Revenue

Taxation Division

P.O. Box 3666

Jefferson City, MO 65105-3666

Fax: (573) 522-1265

Telephone: (573) 751-9268

E-mail: taxclearance@dor.mo.gov